GST Practitioner Training With Latest Amendments

-

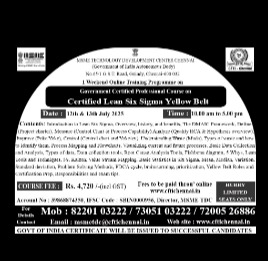

4,720.009:30 AM - 1:30 PMHurry Limited Seats Only

Coverage

- Introduction to Various Tax before GST

- Tax Rates under GST

- CGST, SGST & IGST

- Invoicing Under GST

- GST Registration

- GST Return Filing

- GSTR1 (With Latest update)

- GSTR2B, GSTR3B (With Latest update)

- GSTR07

- Composition Dealer Return

- E-Way Bill, e-invoice GST TDS, GST TCS

- GST Annual Return Filling (9 and 9C)

- LUT Registrations

- GST Refund Process

- Debit Note and Credit Note Process in GST

- GST Practitioner Registration

- DRC03, DRC03A, Notice and Order

- GST PMT 09 (Transfer of Cash Ledger amount from Once tax to Another Tax)

- Cancellation of GST Registration

- Utilization of TDS and TCS in GST in GST Complete

- ITC 04 Complete GST Live Portal Demo.

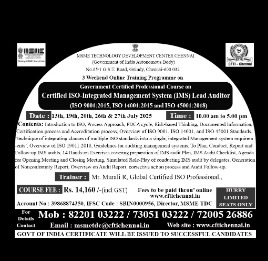

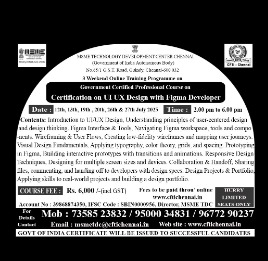

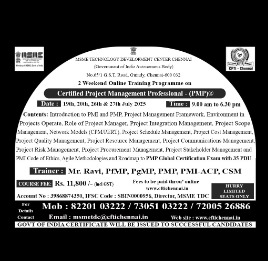

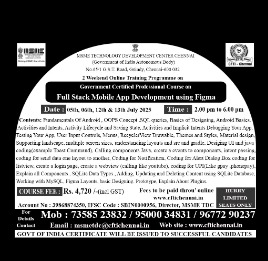

2 Weekend Online Training Progrmme On

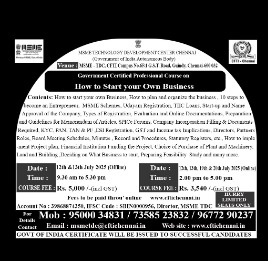

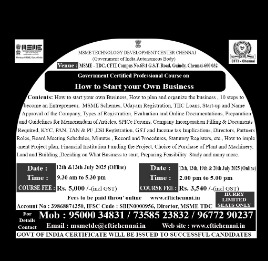

Upcoming Specialised Courses

- Hurry Limited Seats Only

- 10:00 AM - 05:00 PM

14,160.00

- Hurry Limited Seats Only

- 02:00 PM - 06:00 PM

6,000.00

- Hurry Limited Seats Only

- 09:00 AM - 06:30 PM

11,800.00